What Are AWS Reserved Instances (AWS RI)?

Amazon Reserved Instances (RIs) is an EC2 pricing mechanism that lowers the cost of using Amazon Elastic Compute Cloud (EC2), in exchange for a long term commitment to a compute instance for a term of one or three years. Reserved Instances grant a discount of up to 72% compared to on-demand instance rates.

When you purchase a Reserved Instance, you can set properties such as instance type, platform, tenancy, region, and Availability Zone (AZ). You can apply the Reserved Instance discount to existing on-demand compute instances in your Amazon account, or create a new instance and apply the Reserved Instance discount to it.

In this article:

- How Do AWS RIs Work?

- AWS Reserved Instance Marketplace

- What Determines Reserved Instance Pricing?

- AWS RI Strategy and Recommendations

- Automating AWS Reserved Instances with Spot

How Do AWS RIs Work?

In Amazon EC2, a Reserved Instance is a property you can apply to existing on-demand compute instances running in your AWS account. In other words, you “convert” existing on-demand instances to Reserved Instances.

You select RI properties as follows:

- Instance type – the instance type defines the instance family and a size. For example, c5.large is an instance from the C5 family with “large” size.

- Region – the Amazon region where the instance was purchased.

- Tenancy – default tenancy (shared instance) or dedicated instances.

- Platform – the operating system running on the instance (Windows or Linux)

If you define an RI that matches an existing on-demand instance, the discount will be applied to it, and the on-demand instance will be converted to an RI.

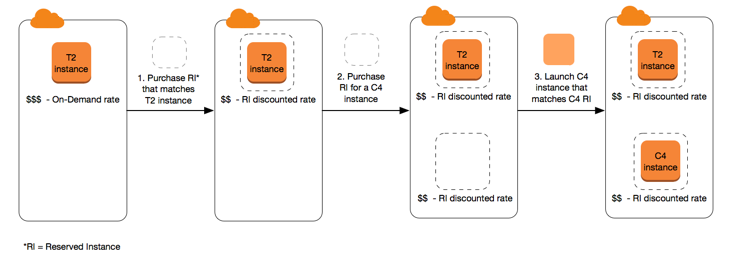

It is also possible to define an RI that does match any existing on-demand instance. In that case the system will wait, and as soon as an on-demand instance is created that matches the criteria, the discount will be applied to it. This is illustrated in the following diagram:

- When the user purchases a T2 Reserved Instance, the discount is applied immediately, because a matching on-demand instance is already running in the account

- However when the user purchases a C4 Reserved Instance, the system waits until a matching instance is available. Only when a C4 on-demand instance is created, the discount is applied.

Image Source: AWS

Related content: Read our guide to EC2 instance pricing

AWS Reserved Instance Marketplace

Reserved Instances have helped enterprises save billions of dollars, but some companies still prefer more flexible payment options. Initially, AWS only offered two RI options (per year or three years) without shorter timeframes. Many organizations found themselves paying for idle RIs when they upgraded or removed their infrastructure.

In response to the demand for greater flexibility, AWS launched the RI Marketplace to allow users to buy and sell Standard Reserved Instances. By opening up the marketplace, AWS enabled companies to sell their idle instances or buy available RIs from a third party for periods as short as one month.

However, there are some requirements for selling on the AWS RI Marketplace. Organizations must register as sellers (using a US bank account). RI sales are limited to $50,000 annual value or 5000 instances, and only EC2 Standard Reserved Instances are eligible for sale. For each successful sale, AWS retains 12% of the upfront cost of the RIs.

Furthermore, given the unpredictability of the market and changing demands, there is no guarantee that an organization will find a buyer for all its RIs. Once the seller lists the price of the RI, it is not possible to modify the listing (only to cancel/deactivate it).

What Determines Reserved Instance Pricing?

Several key variables determine the pricing for Reserved Instances.

Instance Attributes

Each Reserved Instance contains four attributes determining its price:

- Instance type – the size and family of the instance (e.g., m4.small for a small instance from the m4 family)

- Region – the region of the Reserved Instance’s purchase.

- Tenancy – the infrastructure model (i.e., whether the instance runs on default (shared) infrastructure or dedicated (single-tenant) hardware.

- Platform – the operating system (i.e., Windows, Linux).

Commitment Period

Reserved Instances are available for one-year and three-year commitments (the latter offering a significant discount). The one-year option covers 365 days or 31536000 seconds, while the three-year term covers 1095 days or 94608000 seconds.

AWS does not automatically renew Reserved Instances when they expire. You can continue using EC2 instances after the commitment period without interruption but must pay on-demand instance costs. To avoid paying on-demand rates, your organization must terminate the RIs or purchase new ones with the same attributes.

Payment Options

AWS offers the following payment options for Reserved Instances:

- Full upfront payment – you make a full payment at the start of the commitment period. You don’t incur additional costs throughout the period regardless of the hours you use.

- Partial upfront payment – you pay a portion of the cost for the RI upfront with the remaining hours in your commitment term billed at a specified hourly rate, regardless of whether you use the Reserved Instance.

- No upfront payment – AWS bills you at a discounted rate for each hour you use the RI within the commitment period, regardless of usage. You don’t need to pay anything upfront.

Upfront payments generally allow you to save more money, giving you less flexibility. In some cases, third parties may sell Reserved Instances on the AWS Marketplace for shorter commitment periods or lower rates.

Instance Class

When your computing requirements change, you can often exchange or modify your RIs depending on the instance class:

- Standard class – this offering has the biggest discount. You can only modify, not exchange, a Standard Reserved Instance.

- Convertible class – this offering has a lower discount than the standard class but allows you to exchange RIs for other instances with different attributes. You can also modify a Convertible Reserved Instance.

Once you’ve purchased a Reserved Instance, it is not possible to cancel the purchase. However, you can sometimes exchange, modify, or sell Reserved Instances when your needs change.

A common alternative to reserved instances is Savings Plans. Read our guide to AWS Savings Plans

AWS RI Strategy and Recommendations

Here are some ways you can formulate an effective Reserved Instance strategy to ensure you get the best instances for your budget.

Enabling Reserved Instance Recommendations

Enabling Cost Explorer allows you to receive automatic recommendations to help optimize your RI costs. It generates recommendations by identifying your on-demand instance usage patterns, grouping your usage based on RI eligibility, simulating RI combinations, and determining the appropriate type and number of instances.

Performing Right-Size Analysis and Utilization Reports

Resource utilization reports help you identify the EC2 instances you can downsize, terminate, modify, or schedule. The organization should perform regular right-size analyses and implement adjustments to reduce costs. Right-sizing helps you choose the most efficient on-demand options to avoid paying for resources you don’t use.

Updating Instance Families

Identify the instance families your teams use to determine which instances you should update or replace. A new instance family tends to be cheaper and offers improved performance. You can run a utilization analysis to check if your organization uses the right instances for each workload. Your needs may change quickly, so you need to consider this. In some cases, convertible instances are more cost-effective despite their higher price per instance because you don’t have to pay for unused instances.

Implementing a Gradual Purchase Strategy

It is not always possible to know your actual long-term RI needs, so you should avoid paying for full coverage in the beginning. You can always add more instances later on. Starting with approximately 50% coverage is a good way to gauge your needs before purchasing all the instances. Another way to reduce the risk of overspending is to choose the convertible offering. Continuous review and modification after purchasing Reserved Instances helps you ensure the most cost-effective purchase options.

Automating AWS Reserved Instances with Spot

AWS Reserved Instances are a great way to reduce cloud costs, but they have inherent challenges. RIs create financial lock-in for 1 or 3 years, and if not fully utilized can end up wasting money instead of saving it.

Spot addresses this challenge, allowing you to enjoy the long-term pricing of RIs without the risks of long-term commitment.

Key features of Spot’s cloud financial management suite include:

- Intelligent and flexible utilization of AWS Savings Plans and RIs—ensures that whenever there are unused reserved capacity resources, these will be used before spinning up new spot instances, driving maximum cost-efficiency. Additionally, RIs and Savings Plans are fully managed from planning and procurement to offloading unused capacity when no longer needed, so your long-term cloud commitments always generate maximum savings.

- Optimized cost and performance—keeps your cluster running at the best possible performance while using the optimal mix of on-demand, spot and reserved capacity.

- Enterprise-grade SLAs—constantly monitors and predicts spot instance behavior, capacity trends, pricing, and interruption rates. Acts in advance to add capacity whenever there is a risk of interruption.

- Serverless containers—allows you to run your Kubernetes and container workloads on fully utilized and highly available compute infrastructure while leveraging spot instances, Savings Plans and RIs for extreme cost savings.

- Visibility and recommendations—lets you visualize all your cloud spend with the ability to drill-down based on the broadest range of criteria from tags, accounts, services to namespaces, annotations, labels, and more for containerized workloads as well as receive cost reduction recommendations that can be implemented in a few clicks.

Learn more about Spot’s cloud financial management solutions