FinOps, or cloud financial operations, is a method that helps organizations bring financial accountability to their cloud’s operational expenses. To see success, the cross-functional teams leading FinOps efforts — including finance, IT, and business professionals — need the right tools to manage and optimize their cloud costs.

The new GigaOm Radar for Evaluating Financial Operations (FinOps) Tools identifies the criteria and evaluation metrics for selecting a FinOps platform and recognizes vendors and products that excel in their FinOps offerings.

With robust capabilities like Spot Eco and the recent acquisition of CloudCheckr, Spot is leading the way once again. GigaOm has named Spot a leader and outperformer among 13 FinOps vendors evaluated, based on a combination of features, product innovation, and maturity in the FinOps marketplace.

Keep reading to discover how Spot’s FinOps solutions stand out from the competition.

Spot: The choice for CloudOps

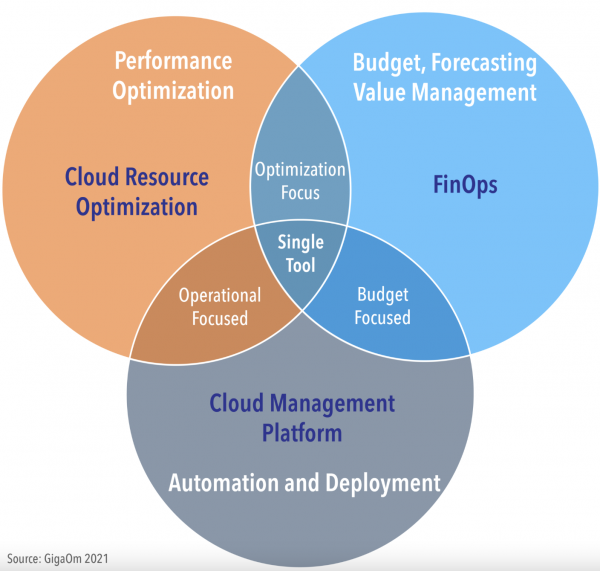

This is the third GigaOm report that has named NetApp and Spot a leader and outperformer in the cloud marketplace. The first, the GigaOm Radar for Cloud Management Platforms, named NetApp a leader and outperformer among platforms, highlighting CloudCheckr as the standout solution. The second report, the GigaOm Radar for Cloud Resource Optimization, highlighted Spot.

With this third report, Spot is the sole leading vendor that supports each of the three aspects that GigaOm defines as total cloud management:

- Automation and deployment: Cloud management platforms

- Application performance optimization: Cloud resource optimization

- Financial accountability: FinOps

From the GigaOm Radar for Cloud Management Platforms

As this latest GigaOm report validates, Spot provides tools for FinOps practitioners in organizations of all sizes. The advantages that Spot can deliver on span the key needs that customers have to design and operationalize FinOps. These include delivering visibility for cloud costs, setting governance for resource SLAs and determining issues to pursue, automating key activities like infrastructure scaling and, finally, optimizing the unit economics of the cloud.

Beyond offering our products to customers, Spot believes it’s important for the market to be educated on the FinOps benefits and best practices, irrespective of specific vendor tools. That’s why Spot is also a proud Premier member of the FinOps Foundation, whose mission is to advance the people and practice of cloud financial management through best practices, education, and standards.

How the GigaOm Radar works

The GigaOm Radar for Evaluating Financial Operations (FinOps) Tools plots vendor solutions across a series of concentric rings. According to GigaOm, the vendors placed closer to the center of the “radar” are judged to be of higher overall value.

The chart shows new entrants on the outermost ring, challengers in the second ring, and a select number of industry leaders at the center circle. Companies displayed in the radar are also ranked as forward movers, fast movers, and outperformers.

The closer to the center the vendors are, the more they strike a balance between maturity in the marketplace and innovation to stay ahead of the competition as well as focus on narrow features versus a broader platform.

Criteria for radar placement for FinOps tools

The GigaOm Radar for Evaluating FinOps Tools first analyzes each vendor according to market categories (SMB, enterprise, multinational, and MSP) and deployment types (software as a service [SaaS], hybrid, self-managed). Spot deploys as SaaS and that GigaOm finds capable or exceptional as a FinOps tool for all of the above market categories.

Next, the report breaks down how vendors address six key criteria:

- Normalized billing across multiple cloud vendors to show directly comparable costs and hide complex, non-standard cloud billing

- Cloud vendor cost comparisons with granular pricing comparisons

- Cloud rate optimization to leverage discounts and provide an accurate picture of cloud spend

- IT finance integration and chargeback leveraging in-house IT finance tools such as SAP, Oracle, and Microsoft

- Identification of cost optimization opportunities using historic consumption trends and cost reduction suggestions

- Real-time decision making using real-time or near-real-time optimization suggestions

Spot received exceptional marks, signaling outstanding focus and execution, in normalized billing across multiple cloud vendors, IT finance integration and chargeback, identification of cost optimization opportunities, and real-time decision making.

The report also analyzes additional evaluation metrics for the usability, flexibility, scalability, monitorability, and interoperability of each platform. Among these evaluation metrics, Spot was ranked exceptional or capable in all five.

Further criteria include GigaOm’s analysis of how well the product or vendor executes against the emerging technologies and trends. These include AI to predict future spending, container and serverless computing, tagging, governance and policy support, and predictive modeling. Spot was ranked exceptional and capable in four of five categories.

What GigaOm says about Spot

GigaOm then provides further insights into each vendor. Here are a few excerpts of what they had to say about Spot’s FinOps tools:

On budgeting and alerting tools with real-time cost analysis:

“Spot processes multiple real-time pricing streams from AWS, Azure, and GCP, including all major account types for each cloud provider. It updates public cloud pricing analysis multiple times per day. Users gain access to numerous budget and alerting options — from application and resource groups to contract management — including defining budget cycles and multiple cost types. They also define alert thresholds or create alerts based on cost fluctuations and spikes when compared to average costs over time.”

On cost analytics and optimization features:

“As Spot has the ability to provide cloud resource optimization (CRO) and automation through its cloud management platform (CMP) features, it can also automate the remediations (changes) to actually optimize costs. MSPs and CSPs get extra value from Spot, as they can charge custom rates for cloud resources automatically, thus reducing the MSP/CSP labor.”

On Spot’s capturing cost data:

“Non-repudiation of financial data reports is a unique [Spot] feature that ensures companies with regulatory requirements of financial accuracy that the reports they generate have not been manipulated and can be trusted. Integration with a wider suite of cloud management and automation tools places [Spot] in a leadership role that will help the market respond to its new abilities.”

Continue the FinOps Education Process

We think Spot is a great choice for organizations to support their FinOps initiatives and are fortunate to have many customers who agree! The first step in determining fit, however, is deepening your understanding of the market. We encourage you to check out GigaOm’s latest report that names Spot a Cloud FinOps leader.