While buying AWS Savings Plans and reserved instances can potentially reduce EC2 costs by up to 70%, the 1- or 3-year commitment required to achieve these savings can sometimes end up wasting more money than if you had stayed with on-demand pricing. In this article, we will explore why AWS commitments can be tricky and how buying shorter-term RIs on the Amazon Reserved Instance Marketplace can be done successfully.

Dynamic compute requirements can wreck your reserved instance strategy

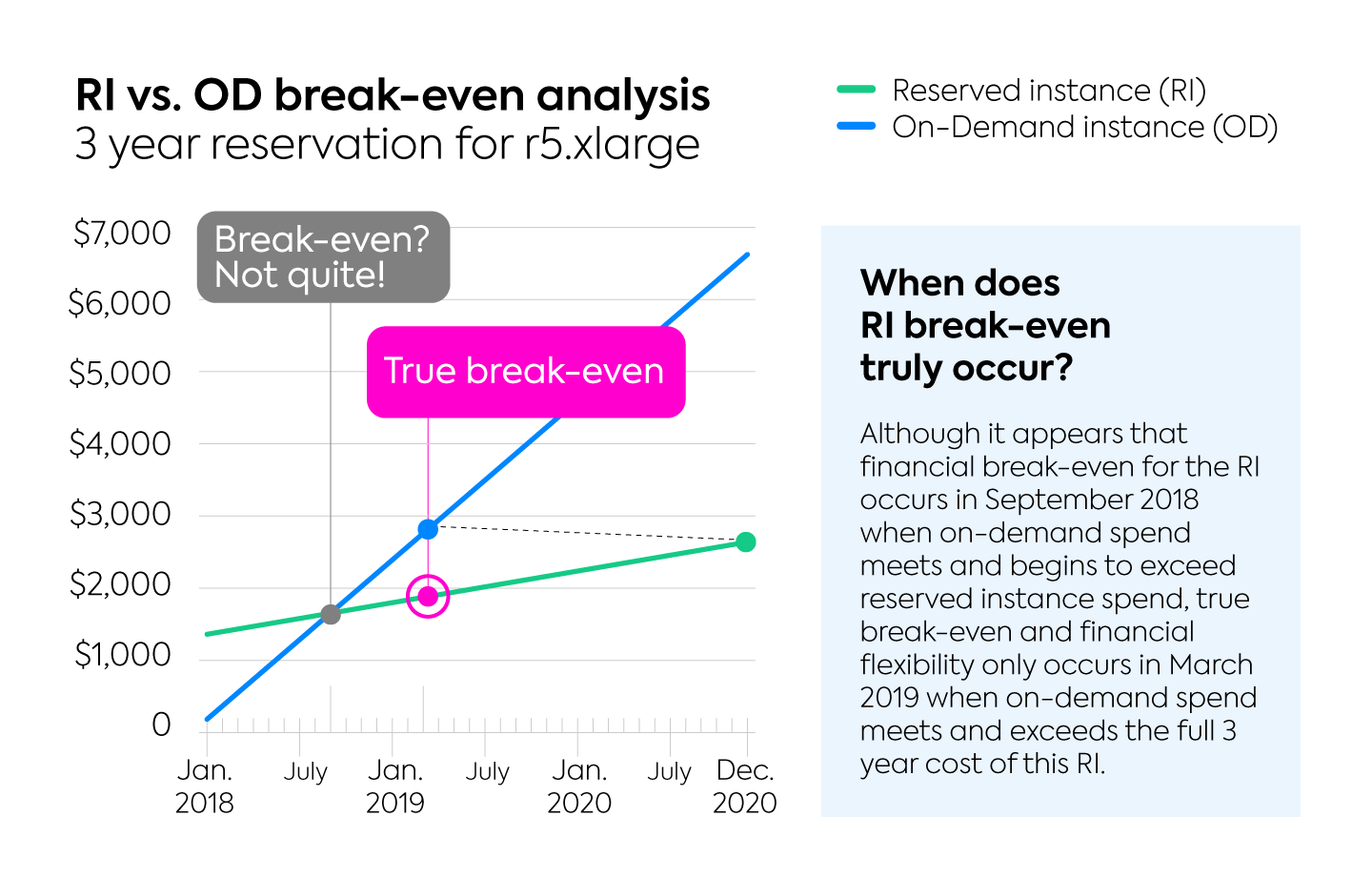

One fine day your application engineer tells you he will need r5.xlarge instances for his dev environment. He explains that if you buy 3-year partial upfront standard reservations to cover those instances it will be 60% less than the on-demand rate. Of course, he figured out how much he needs to use those instances over the course of 3 year to break even and how long before he saves 60% in comparison to on-demand instances (see graph below).

But what happens when AWS introduces a far better instance type, more suitable for the workloads your engineers are developing? Well, innovation and speed to market come first and chances are that those reservations you bought and paid for will go unused, never breaking even let alone saving any money. And what is worse, is that you will then go and pay on-demand rates for the new instance type.

Another common scenario is that despite the best assessment and planning, the projects that the reserved instances were purchased for end early due to some unforeseen circumstance.

You might think these are exaggerated, but things like these play out all the time. While AWS does offer convertible reservations and Savings Plans which allow for some flexibility, there are always trade-offs (read more about that here).

So, is there a way to use reserved capacity in a more risk-free way? We certainly think so.

Long-term savings with short-term commitments

AWS allows you to sell your unused, standard RIs to other AWS customers via their Reserved Instance Marketplace. If you are on the buy-side of things, you can find RIs that offer 1- or 3-year rates, but for far less upfront cost and far shorter commitment terms (e.g., a 1-year RI that has 3 months left on its term). This means you can get 50-70% cost savings even for short-term projects that will only last a few months, helping you significantly reduce your cloud spend overall and without the risk of long-term lock-in.

We call these deals “marketplace opportunities” as you need to constantly be on the search for them as they go fast.

Eco constantly monitors the AWS RI Marketplace

Here at Spot, our Eco product is constantly scanning the AWS Reserved Instance Marketplace for these types of deals, buying them immediately on behalf of our customers who need them.

Recently we purchased hundreds of AWS reserved instances for a customer at well below market rates. Eco identified the 3rd party listing of 3 year RIs which only had 9 months left on their term. Moving quickly, Eco purchased the entire lot, delivering a savings rate of 63% for our customer. In many cases, these quick “marketplace opportunity” deals will significantly impact the annual cloud budget.

These deals work in both directions and Eco helps our customers quickly and easily offload RIs that are no longer being used, helping eliminate cloud waste.

The result of all this is more efficient reserved capacity coverage with lower commitment terms and higher savings. Of course, Eco also helps lower the significant human resource efforts for planning, buying and managing RIs and Savings Plans.

These are just some of the ways that Eco helps AWS customers achieve 40% higher savings than they would be managing Savings Plans and RIs on their own. Find out more today!